tax shield formula uk

Interest Tax Shield Interest Expense Tax Rate. The formula for this calculation can be presented as follows.

Depreciation Tax Shield Formula Examples How To Calculate

The formula for calculating the interest tax shield is as follows.

. In this video on Tax Shield we are going to learn what is tax shield. Web formula shield tax uk. This companys tax savings is equivalent to the interest payment.

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. 1 For example because interest on debt is a tax-deductible expense taking. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Web formula shield tax uk. For instance if the tax rate is 210 and the.

What is the formula for tax shield. Taxes 8 million 20 16 million. The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Net Income 10 million 2 million 8 million. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Interest Tax Shield Example. Net Income 8 million 16.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Web Tax Shield Deductible. Interest Tax Shield Formula.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Or the concept may be applicable but have less. Web A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Companies using a method of accelerated depreciation are able to save more money on tax payments due to the. Taxes 10 million 20 2 million.

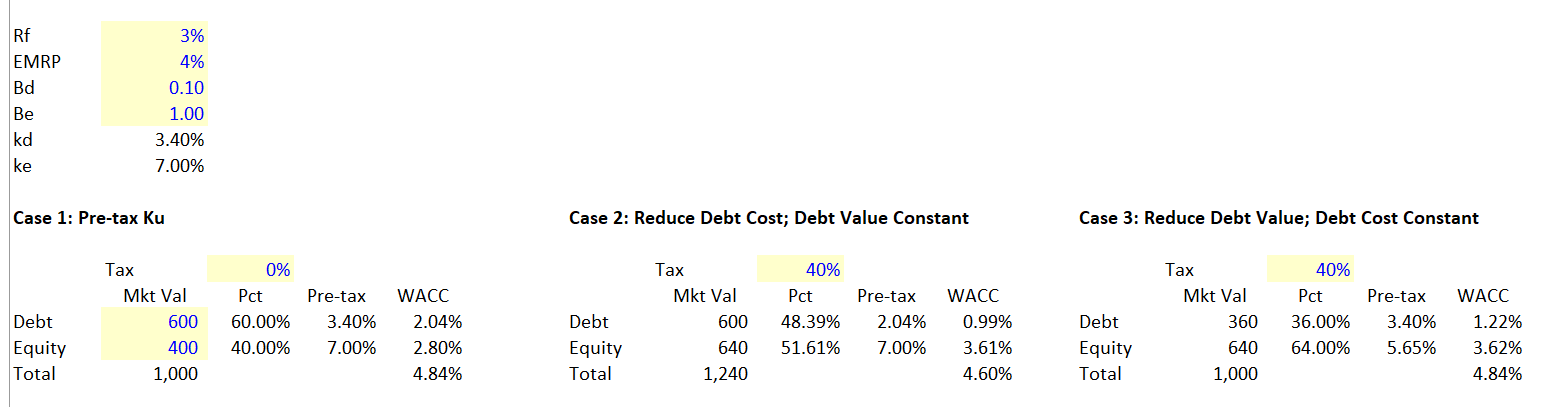

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Discounted Cash Flow Dcf Valuation Investment Guide

Serum Nykaa Switzerland Save 36 Loutzenhiserfuneralhomes Com

Palmer S Cocoa Butter Formula Length Retention Shine Glaze Serum 6 Fl Oz Walmart Com

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Debt Tax Shields Around The Oecd World

Pdf Tax Rate And Non Debt Tax Shield

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Zhou Guanyu Says Halo Device Saved His Life After British Gp Horror Crash Formula One The Guardian

Interest Tax Shield Formula And Calculator

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Discounted Cash Flow Dcf Valuation Investment Guide